What is a Registered Agent Service? Essential Guide for U.S. Business Formation

- Read & Associates

- 2 days ago

- 16 min read

When you form a company in the United States, state law requires you to designate an official, physical point of contact within the state where your business is registered. This isn't just a mailing address; it's a critical legal requirement. This is the role of a registered agent service—a designated individual or company responsible for receiving legal and government documents on your behalf.

Think of them as your company's official liaison with the state. A registered agent ensures that time-sensitive and crucial notices, such as a lawsuit or a tax summons, are promptly delivered to you. For any U.S. LLC or corporation, appointing and maintaining a registered agent is a non-negotiable part of doing business.

Your Business’s Official Link to the State

State governments need a reliable, consistent method to communicate with your business for official matters. This channel isn't for marketing materials or general correspondence—it's reserved for high-stakes communications that directly impact your company's legal standing. Your registered agent serves as this crucial, official conduit.

This role is far more than a simple mail-forwarding service. It is a fundamental component of your company's legal framework, ensuring you never miss a critical message from the state or the courts. As a business owner, understanding this function is the first step toward building a compliant U.S. entity.

To provide a clearer picture, let's break down the key functions.

Registered Agent Service at a Glance

Key Aspect | Description for U.S. Business Owners |

|---|---|

Official Point of Contact | The agent is your company's designated recipient for all official government and legal mail. |

Physical Address Requirement | Must maintain a physical street address (no P.O. Boxes) in your state of formation. |

Business Hours Availability | Must be available during standard business hours (9 AM to 5 PM, Mon-Fri) to accept documents in person. |

Document Handling | Receives and forwards crucial items like lawsuits (Service of Process), tax notices, and annual report reminders. |

Compliance Function | Helps your company stay in "good standing" with the state by ensuring critical deadlines aren't missed. |

This table illustrates why the registered agent is so central to your company’s compliance. It's the system the state relies on to know it can always reach your business for legal and administrative matters.

The Core Function of a Registered Agent

At its heart, a registered agent’s job is to be available to receive and forward important documents without fail. It is an active responsibility that demands constant reliability.

Here’s what they typically handle:

Service of Process: This is the formal term for legal notices, such as a summons or complaint, if your company is sued. Missing one of these is a significant risk to your business.

Official State Correspondence: This includes annual report reminders, franchise tax notices, and other compliance communications from the Secretary of State.

Government Notices: Any other official letters from state agencies will be sent directly to your registered agent.

For your company to remain in good legal standing, it must have a dependable way to receive these documents. Your registered agent is your first line of defense, making sure crucial legal and state communications are received immediately, protecting you from the serious consequences of non-compliance.

Why a Professional Service is a Must for International Founders

The requirements for serving as a registered agent are strict. You must have a physical street address in the state where your company is registered—P.O. boxes are not permitted. Furthermore, someone must be physically present at that address during all standard business hours, typically 9 AM to 5 PM on weekdays.

For a founder living outside the U.S., meeting these requirements on your own is practically impossible. This is precisely why a professional registered agent service is not just a convenience; it's an operational necessity for building a compliant U.S. business.

The market for these services is substantial for this reason. The global LLC registered agent segment is valued at around USD 1.74 billion and is expected to continue its growth. This trend is fueled by the hundreds of thousands of new businesses formed in the U.S. each year, every one of which needs a compliant contact. You can explore more data on this industry's growth to understand its vital role in the U.S. business ecosystem.

A professional service guarantees someone is always available to sign for documents. This protects you from the nightmare scenario of missing a lawsuit notice and having a default judgment entered against your company. For global entrepreneurs, it’s the only realistic path to staying compliant and secure.

The Core Legal Duties of a Registered Agent

While a registered agent’s primary job is to be your company's official point of contact, their role is much deeper than just accepting mail. A professional registered agent service handles specific legal duties that are absolutely critical for your company’s compliance and long-term health. Once you understand their responsibilities, you’ll see why this isn't a role to take lightly, especially if you're running your business from outside the U.S.

The most important duty is accepting what is legally termed "service of process." This is the formal, legal delivery of court documents—like a summons or a lawsuit—that officially notifies your company it's being sued. This isn't just another letter in the mail; it's a hand-delivered notice that initiates legal proceedings.

Missing this one delivery can have catastrophic consequences. Your agent is your designated recipient, ensuring these incredibly time-sensitive documents are received properly and forwarded to you immediately.

Accepting Service of Process: Your First Line of Defense

Imagine a scenario: a client in the U.S. decides to sue your company. The first legal step they must take is to formally "serve" your business with the lawsuit. They cannot simply email it to you. The law requires them to physically deliver the paperwork to your registered agent's address during normal business hours.

Your agent accepts the documents on your behalf, signs for them, and then immediately transmits them to you. This single, simple action is what provides the critical window you need to consult an attorney and begin preparing your defense.

Without a reliable agent, you might not even know you've been sued until a court has already ruled against you. This is called a default judgment, and it means you lose the case automatically simply because you never responded. The result could be crippling financial penalties or even the seizure of your company's assets.

This is why a registered agent is often called a protective shield. They provide the legal system with a legitimate channel to reach you, which in turn protects your fundamental right to defend your business in court. For an international founder, having this reliable link is non-negotiable.

Handling Official State and Tax Notices

Beyond lawsuits, a registered agent also handles all official correspondence from state agencies. This mail is just as crucial for keeping your company in good standing and avoiding unnecessary fines.

These government notices often include things like:

Annual Report Filings: Most states require you to file an annual or biennial report to keep your company’s information current. Your agent receives the official reminders, helping you sidestep late fees or even having your business dissolved for non-compliance.

Franchise Tax Notices: States like Delaware charge a franchise tax for the privilege of incorporation. The official tax forms and payment reminders go straight to your agent, making it easier to stay on top of your tax obligations.

State Compliance Alerts: If there’s ever an issue with your company’s status, the Secretary of State will notify your agent. This could be a delinquency notice or a warning that your business is at risk of losing its "good standing" status.

By managing this constant stream of official mail, your agent acts as a compliance filter. They sort through everything, ensuring that only the critical, time-sensitive government documents get to you right away. This system keeps you organized and ahead of deadlines—a huge challenge for any founder, but a game-changer for someone managing a U.S. company from abroad.

If you need help navigating your U.S. compliance obligations, we are here to guide you. Feel free to contact Read & Associates Inc. for a consultation.

Why Non-Resident Founders Can’t Afford to Ignore This

For international entrepreneurs, a registered agent service isn't just another item on a startup checklist. It's the very foundation of your company's legal presence in the United States. The rules are clear, and for founders operating from abroad, they present unique hurdles that must be addressed from the very beginning.

The single most important rule is this: your registered agent must have a physical street address in the state where your company is incorporated. This is completely non-negotiable. An address outside the U.S., no matter how official, will not suffice. P.O. boxes are also prohibited. The law demands a real, physical location where an individual can personally accept legal papers during normal business hours.

The Inescapable Need for a U.S. Physical Address

This physical presence requirement is precisely why a professional registered agent service is essential for global founders. Unless you have a trusted partner on the ground who can meet these strict criteria, you cannot fulfill this core legal requirement. Attempting to use a non-compliant address puts your entire U.S. business in jeopardy from day one.

Consider it from the state government's perspective. They view the registered agent as the one guaranteed method of contacting your company about serious legal matters. If that communication channel is broken—for instance, if a court official arrives to find a P.O. box or an empty office—the state considers you out of compliance. This isn't a minor administrative slip-up; it's a fundamental breakdown that can lead to severe consequences.

The High Stakes of Non-Compliance

Failing to maintain a valid registered agent is one of the fastest ways to jeopardize your U.S. company. The fallout isn't just about paying a fine; it can completely unravel the legal protections you worked so hard to establish.

Here’s what typically happens when you fall out of compliance:

Loss of Good Standing: The state will revoke your company's "good standing" status. This is a significant issue. It can instantly block you from opening a bank account, securing a loan, or even signing contracts.

Fines and Penalties: States impose financial penalties on non-compliant businesses, and these can accumulate quickly. What starts as a simple oversight can become a serious, unexpected expense.

Administrative Dissolution: This is the worst-case scenario. The state can forcibly dissolve your LLC or corporation. At that point, your company legally ceases to exist, and the limited liability shield that protects your personal assets vanishes. You could suddenly become personally liable for business debts and lawsuits.

For an international founder, these risks are amplified. An administrative dissolution doesn't just shut down your U.S. operations; it can create a complex web of cross-border tax and legal problems. A registered agent is your insurance policy against this kind of catastrophic failure.

The sheer growth of the registered agent market demonstrates how critical this role has become. Globally, it’s already a market worth around USD 2.0 billion and is projected to hit USD 6.0 billion as more businesses operate remotely and regulations tighten. If you want to dig into the numbers, you can review the full market analysis on registered agent services.

Your Non-Negotiable Compliance Partner

Ultimately, a registered agent isn’t just a bureaucratic hoop to jump through—it's a core component of your U.S. compliance framework. It's what protects your company’s legal status, shields you from losing a lawsuit by default, and ensures your business can operate without interruption. It is the proof that your company has a legitimate presence in the U.S. legal system, even if you are managing it from halfway across the world.

Getting this right, along with other key steps like EIN acquisition, lays the groundwork for a solid U.S. entity. As experts in U.S. business formation for non-residents, we ensure this vital role is filled correctly, protecting your investment and clearing the path for your success.

How to Choose the Right Registered Agent

Selecting a registered agent is one of the first and most critical decisions you'll make for your U.S. company. It’s not just about checking a box on a form—it’s about finding a reliable partner to protect your business from very real legal and financial risks.

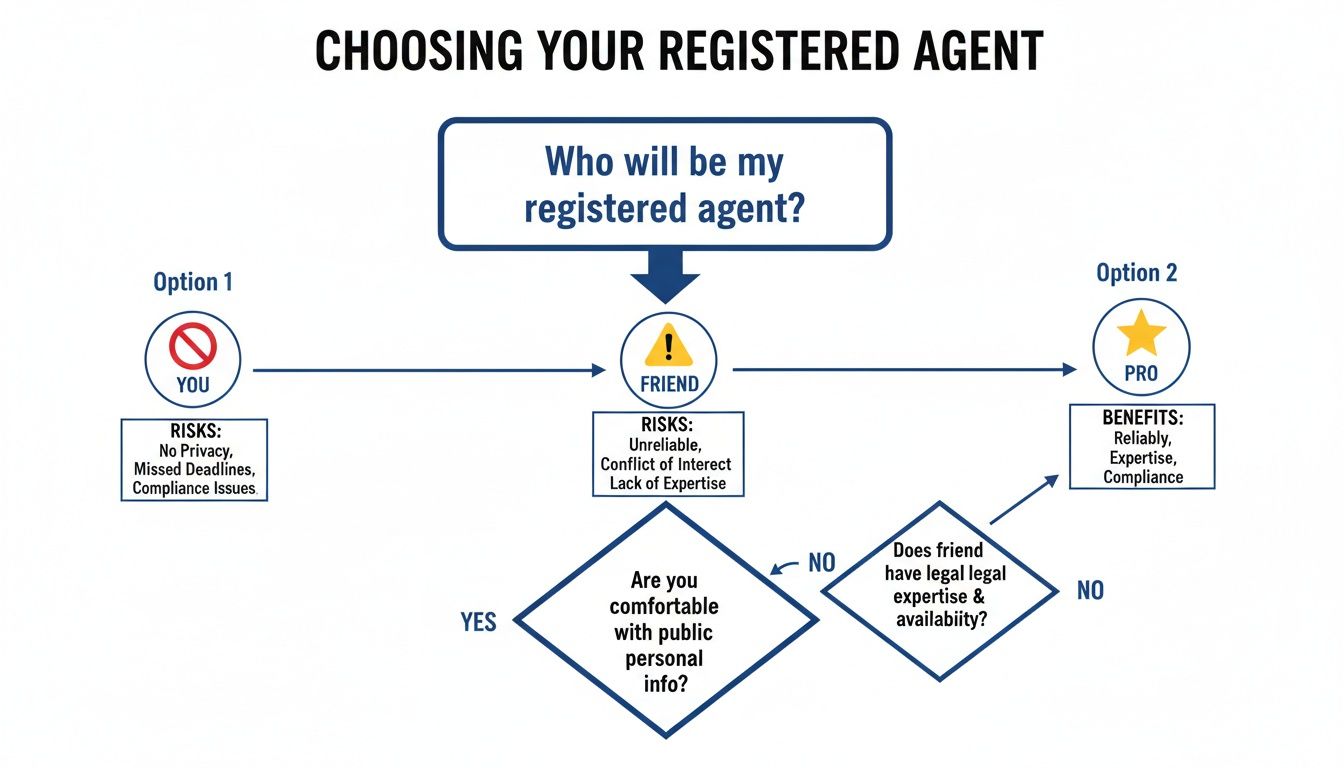

As an international founder, you have a few options. You could, in theory, ask a U.S.-based friend or hire a professional service. (Acting as your own agent is a non-starter for anyone without a physical U.S. address in the state of formation). Let’s unpack these options and see why this choice is so important for your company's foundation.

Comparing Registered Agent Options for Your U.S. Company

When you boil it down, your choice directly impacts your company's legal standing and your peace of mind. For founders managing a business from overseas, the margin for error is razor-thin, which makes a professional service the only truly viable path. The risks associated with the alternative are simply too high.

Let's lay out the options side-by-side to make it crystal clear.

Option | Pros | Cons / Risks for Non-Residents |

|---|---|---|

Acting as Your Own Agent | No cost. | Impossible for non-residents. You must have a physical street address in the state and be available during all business hours. Plus, your address becomes public record. |

Asking a Friend or Colleague | Low or no cost. | Extremely high risk. You’re handing over a serious legal responsibility to a non-expert. One missed document, vacation, or move could put your company in default. |

Hiring a Professional Service | Guaranteed compliance, privacy, and immediate handling of legal documents. | Involves a reasonable annual fee. |

As you can see, the annual fee for a professional service isn't a cost—it's an investment in risk management, protecting you against the potentially catastrophic outcomes of the "free" options.

The Problem with Appointing a Friend

It's tempting to ask a friend or an associate based in the U.S. to be your registered agent to save on annual fees. However, this mixes a personal relationship with a serious legal duty, and it's a recipe for potential disaster.

Consider what you're really asking. You are entrusting them with a critical legal function that requires them to be physically present at a specific address every single business day from 9 AM to 5 PM. What happens if they go on vacation? Or get sick? Or simply have a busy week and forget to check the mail?

A single missed "service of process" could lead to a court issuing a default judgment against your company because you never appeared to defend yourself. That mistake could cost you thousands, all to save a small annual fee. On top of that, their personal address is now listed on the public record, tied to your company. It’s a significant burden to place on any relationship.

What to Look For in a Professional Service

So, you’ve decided to go with a professional—a wise choice. But not all services are created equal. A cheap, bare-bones provider might just forward your mail and call it a day. A great one, however, acts as a genuine compliance partner.

Here’s a quick checklist of what really matters:

Speed and Reliability: When a legal notice arrives, time is of the essence. How quickly do they scan and upload your documents? Look for a service that guarantees same-day digital access so you can act immediately.

National Coverage: You might start your business in Delaware or Wyoming, but what if you expand to California or New York next year? A provider with agents in all 50 states saves you the massive headache of finding and vetting new partners down the road.

Integrated Compliance Tools: The best services do more than just receive mail. They offer helpful tools like annual report reminders and a secure online dashboard where you can manage documents and track key deadlines.

Additional Business Services: Your U.S. journey involves more than just a registered agent. A partner who can also handle your company formation, EIN acquisition, and tax compliance creates a single, streamlined support system.

Choosing an integrated provider like Read & Associates Inc. means your registered agent service works in harmony with your accounting and tax compliance. This creates a seamless support system, ensuring no detail is overlooked as you build and scale your U.S. business.

Ultimately, your registered agent is your company’s anchor in the U.S. legal system. Choosing a professional, reliable partner is an investment in your company's stability and long-term success. It buys you the peace of mind to focus on what you do best—running your business.

If you need a partner who understands the unique challenges faced by non-resident founders, get in touch with us for a consultation.

Appointing and Changing Your Registered Agent

Appointing a registered agent is one of the very first steps you'll take on your U.S. business journey. It happens right at the beginning, during company formation. But what if you need to switch agents later on? The process is straightforward. Both appointing and changing your agent are simple administrative filings, not complicated legal procedures, so you can always be sure you have the right partner on your side.

When you first form your LLC or corporation, the documents you file with the state—usually called the Articles of Organization (for an LLC) or Articles of Incorporation (for a corporation)—will have a specific section for your registered agent’s name and physical address. This part is mandatory. If you leave it blank, the state will reject your formation filing.

This initial appointment officially places your registered agent on the public record as the designated contact for your company. From that moment forward, the state knows exactly where to send crucial legal documents and official tax notices.

The Initial Appointment Process

Appointing your first agent is a natural part of the company formation process. In fact, if you're working with a professional service like Read & Associates Inc. to set up your business, we handle this for you.

You provide us with your business details, and we’ll list our own compliant service as your registered agent on all the paperwork filed with the Secretary of State. This ensures your company is compliant from day one. It’s a simple but absolutely vital step.

This decision tree gives you a good visual of the options and shows why a professional service is the only secure choice for founders living outside the U.S.

As you can see, other options either come with serious risks or are simply impossible for international entrepreneurs. That makes a professional service the most reliable path forward.

Why You Might Need to Change Your Registered Agent

Businesses grow and evolve, and sometimes your needs change along with them. Switching your registered agent is a normal business activity. You aren't locked into your first choice forever, and there are plenty of good reasons to make a change.

Business owners often switch agents for reasons like these:

Poor Service: Perhaps your current agent is slow to forward documents, difficult to reach, or lacks a modern online portal to access your mail.

High Fees: You might discover your current provider is overcharging for basic services or has undisclosed "hidden" fees.

Service Consolidation: Many founders prefer to bundle services for efficiency. It's often easier to have your registered agent, accounting, and tax services all under one roof with a single, trusted provider.

Expanding to New States: If your business is expanding into other states and your current agent doesn't have offices there, you’ll need a new partner with a nationwide presence.

Changing your registered agent isn't a red flag or a sign of trouble. It's a smart business move to ensure you have the best possible support for your company's compliance needs. The state process is designed to be simple, preventing any gaps in coverage.

How to Officially Change Your Agent

Making the switch involves filing one specific form with the Secretary of State where your company is registered. The form is typically called a "Statement of Change of Registered Agent" or something similar.

The process usually boils down to these four simple steps:

Hire Your New Agent: First, sign up with your new professional registered agent. They will provide their official details needed for the state filing.

File the Change Form: You or your new service provider will complete and submit the change form to the state. This officially updates the public record with your new agent’s information.

Pay the Filing Fee: States charge a small fee to process this change, usually somewhere between $5 and $50.

Notify Your Old Agent: While not always a legal requirement, it is good business practice to inform your previous agent that you've made a switch.

This whole process is built to be seamless. A good professional service can handle the entire filing for you, ensuring there's never a moment when your company is without a registered agent. If you're thinking about making a change or just need some guidance, feel free to get in touch with our experts at Read & Associates Inc. for a smooth transition.

Common Questions from International Founders

Setting up a business in the U.S. from another country can feel like navigating a complex maze. One of the first, and most important, pieces of the puzzle is understanding the role of a registered agent. To provide clarity, we've compiled answers to the most common questions we hear from international founders just like you.

Think of this as your practical, no-nonsense guide to the specific hurdles and misconceptions that often challenge non-resident owners.

Is a Registered Agent the Same as a Virtual Business Address?

This is a common point of confusion. The short answer is no, they are not the same thing. While the same company might offer both services, they fulfill two completely different functions for your business.

A registered agent exists for one specific, legally mandated purpose: to be the official point of contact for government notices and legal documents, like a lawsuit. This requires a physical street address where someone is available during business hours to accept these critical deliveries. It is a non-negotiable legal requirement.

A virtual business address, on the other hand, is for your everyday commercial mail—correspondence from customers, vendors, banks, and marketing materials. It’s an excellent tool for professionalism and privacy, but it does not satisfy the state's legal requirement for a registered agent. At Read & Associates Inc., we can help you set up both, ensuring you're covered on all fronts.

Can I Be My Own Registered Agent If I Visit the U.S. Frequently?

It's a logical question, but unfortunately, this is not a realistic option for non-resident founders. The rules for being your own agent are incredibly strict, making it practically impossible for someone living abroad to comply.

Here’s why: you must have a physical street address (no P.O. boxes) in the state where your company is formed. More importantly, you have to be physically present at that address during all standard business hours—typically 9 AM to 5 PM, Monday through Friday.

Simply visiting frequently or staying for a few months does not meet this requirement. The law demands continuous availability. Missing the delivery of a single legal notice could have disastrous consequences, which is why a professional service is essential. It guarantees someone is always there to receive those time-sensitive documents for you.

For international founders, the only reliable way to meet this legal requirement is by hiring a professional service. This ensures your company remains in good standing and protected from legal risks, no matter where in the world you are.

What Happens If I Fail to Maintain a Registered Agent?

This isn't a minor administrative slip-up; the consequences are serious and can put your entire U.S. business at risk. The state views this as a major compliance failure, and the repercussions can be swift.

If you let your registered agent service lapse, the state has the power to:

Administratively Dissolve Your Company: They can revoke your company’s legal status, effectively shutting you down.

Strip Your Liability Protection: Once your company is dissolved, the "corporate veil" disappears. This could make you personally liable for business debts and lawsuits.

Impose Fines and Penalties: States will issue financial penalties for non-compliance, and they can accumulate quickly.

Revoke "Good Standing" Status: Your business will lose its good standing, making it impossible to open a bank account, get a loan, or even legally operate.

This is a foundational piece of your business structure that is too important to get wrong.

How Does a Professional Service Handle My Official Documents?

We understand that as an international founder, you need fast, secure access to your documents, regardless of your time zone. At Read & Associates Inc., our entire process is built around this reality.

The moment an official legal or state document arrives for your company, our team gets to work. We immediately scan it and upload it to your secure online portal. Simultaneously, we send an email notification so you know something important is waiting for you. This digital-first system eliminates the slow, unreliable process of international mail forwarding, giving you the power to act immediately.

This kind of digital organization is also key for other vital records. For instance, if you misplace your federal tax ID, our guide on how to retrieve my EIN number can walk you right through the process.

Navigating the complexities of U.S. compliance is what we do best. At Read & Associates Inc., we're more than just a registered agent service—we are a complete support system for international founders. From company formation and obtaining your EIN to ongoing accounting and tax filing, we ensure your U.S. venture is built on a rock-solid, compliant foundation.

Ready to launch or grow your U.S. business with confidence? Contact us for a consultation today and let us handle the details, so you can focus on building your vision.

Comments