A Guide to changing registered agent in texas: What You Need to Know

- Read & Associates

- 18 hours ago

- 14 min read

Changing your registered agent in Texas is a common, and often necessary, step in the life of a business. While it might seem like a simple administrative task, getting it right is crucial for keeping your company in good legal standing and protecting it from unnecessary risk. The process itself boils down to filing a specific form with the Texas Secretary of State, but understanding the why and the how is where business owners can truly safeguard their operations.

At Read & Associates, we help business owners navigate these requirements every day. This guide will walk you through the process, highlight common pitfalls, and ensure you handle this change with the expertise it deserves.

Why Bother Changing Your Texas Registered Agent?

Making a switch isn't just about updating a name and address in a state database. It's a strategic move that directly affects your company's ability to receive critical legal notices and stay compliant. For many business owners, changing their registered agent signifies an important transition—often from a "do-it-yourself" startup phase to a more professionally managed operation.

Think of your registered agent as the dedicated, official recipient for your most important legal and state correspondence. If that channel is unreliable or unattended, you risk missing a summons, a tax notice, or a compliance deadline that could put your entire business in jeopardy. A professional agent ensures this never happens.

The Most Common Reasons for a Switch

So, what pushes a business owner to make this change? In our experience helping countless businesses, it usually comes down to a handful of practical, real-world scenarios.

You're Expanding: As your business grows beyond Texas, managing compliance in multiple states becomes a headache. A professional registered agent service can provide a consistent presence in every state you operate in, which is a massive administrative relief.

The DIY Method Isn't Working Anymore: Many founders start out acting as their own agent to save money. But that means you have to be physically present at a Texas address every business day from 9 to 5. This is simply not practical once your business starts to take off or if you operate from outside the U.S.

You Want More Privacy: When you use your home or primary office as your registered address, it becomes public record. Anyone can look it up. Switching to a professional service shields your personal or operational address from public view, protecting you from unwanted solicitations.

Your Current Agent Isn't Cutting It: Perhaps you asked a friend or family member to handle it initially. While well-intentioned, this can lead to missed mail or delays. A dedicated service is built for one purpose: to receive and forward your documents reliably and on time, every time.

Key Reasons for Changing Your Registered Agent

To put it all into perspective, here's a quick summary of the strategic reasons a business might decide it's time for a new registered agent.

Reason for Change | Impact on Your Business | How a Professional Service Helps |

|---|---|---|

Business Growth | Expanding into new states adds significant compliance burdens. | Offers a single point of contact and a physical address in all 50 states, simplifying multi-state management. |

Privacy Concerns | Listing a home or office address on public records invites unwanted solicitations and privacy risks. | Provides a commercial address to list publicly, keeping your personal or primary business address private. |

Unreliable Service | Using an individual (friend, family, or even yourself) can lead to missed documents if they are unavailable. | Guarantees someone is always available during business hours to receive time-sensitive legal notices. |

Relocation | Moving your business or personal residence out of state means you no longer meet the physical address requirement. | Maintains a consistent, compliant physical address in Texas regardless of where you or your business moves. |

Choosing the right registered agent is a foundational decision that supports your business's legal health for the long term.

In Texas, failure to maintain a registered agent isn’t a minor slip-up. It's a violation that can lead to the state involuntarily terminating your company or revoking its registration.

This requirement is more important than ever. The number of active business entities in Texas has skyrocketed, growing by roughly 101% in the last decade to nearly 3 million. With that much activity, the state's compliance systems are on high alert. You can read more about the state's official requirements on the Texas Secretary of State website.

Ultimately, it’s best to see this change not as a chore, but as a strategic upgrade. It’s an opportunity to fortify your business's legal foundation. For a complete breakdown of this critical role, take a look at our detailed guide on what a registered agent is and why your business needs one.

Gathering Your Information Before You File

Before you touch a single state form, the secret to a smooth registered agent change lies in preparation. We've seen countless business owners rush this step, only to have their filing rejected because of a simple, avoidable mistake. Taking ten minutes to get your information in order will save you hours of frustration later.

Think of it like this: the Texas Secretary of State is meticulous. Any discrepancy on Form 401 (Statement of Change of Registered Agent/Office) can send you right back to square one.

Your Pre-Filing Checklist

To ensure your filing is accepted on the first try, gather and confirm these details before you start.

Your Entity's Exact Legal Name: This isn't the time for abbreviations or your trade name. You need the full, official name of your company as it's registered with the state, right down to the "LLC," "Inc.," or "Ltd."

Your State File Number: Every business in Texas is assigned a unique file number by the Secretary of State. If you don't have it handy from your formation documents, a quick search on the state's online business database will provide it.

The New Agent's Full Name and Physical Address: Your new registered agent must have a legitimate street address in Texas where someone can physically accept documents during business hours. A P.O. Box is an absolute no-go and will result in an instant rejection.

Consent from the New Agent: This is a crucial and surprisingly easy step to overlook. You must obtain your new agent's written permission before you name them in your filing. The form itself requires you to certify that this consent has been obtained.

A classic mistake we see involves founders switching from using a friend as their agent to a professional service. They'll file the change but forget to actually sign the service agreement or get a formal consent letter first. This makes the filing invalid, and sometimes the new agent doesn't even know they've been appointed.

This preparation phase is also the perfect time for a quick business health check. Are your internal records, like your management structure, up to date? And what about your federal information? For a refresher, take a look at our guide on what an EIN is and how you get one.

Once this checklist is complete, the filing becomes a simple, straightforward task, keeping your business compliant and protected.

How to Navigate the Texas Filing Process

You've gathered your information. Now it's time for the main event: filing the Texas Form 401, Statement of Change of Registered Agent/Office. This isn't just another piece of paperwork; it's an official update to your company's public record and a critical step in maintaining your legal standing. Getting it right the first time is key to avoiding delays and compliance issues.

Think of it this way: you're officially notifying the state of your company's legal point of contact. It’s a vital piece of your business's public record.

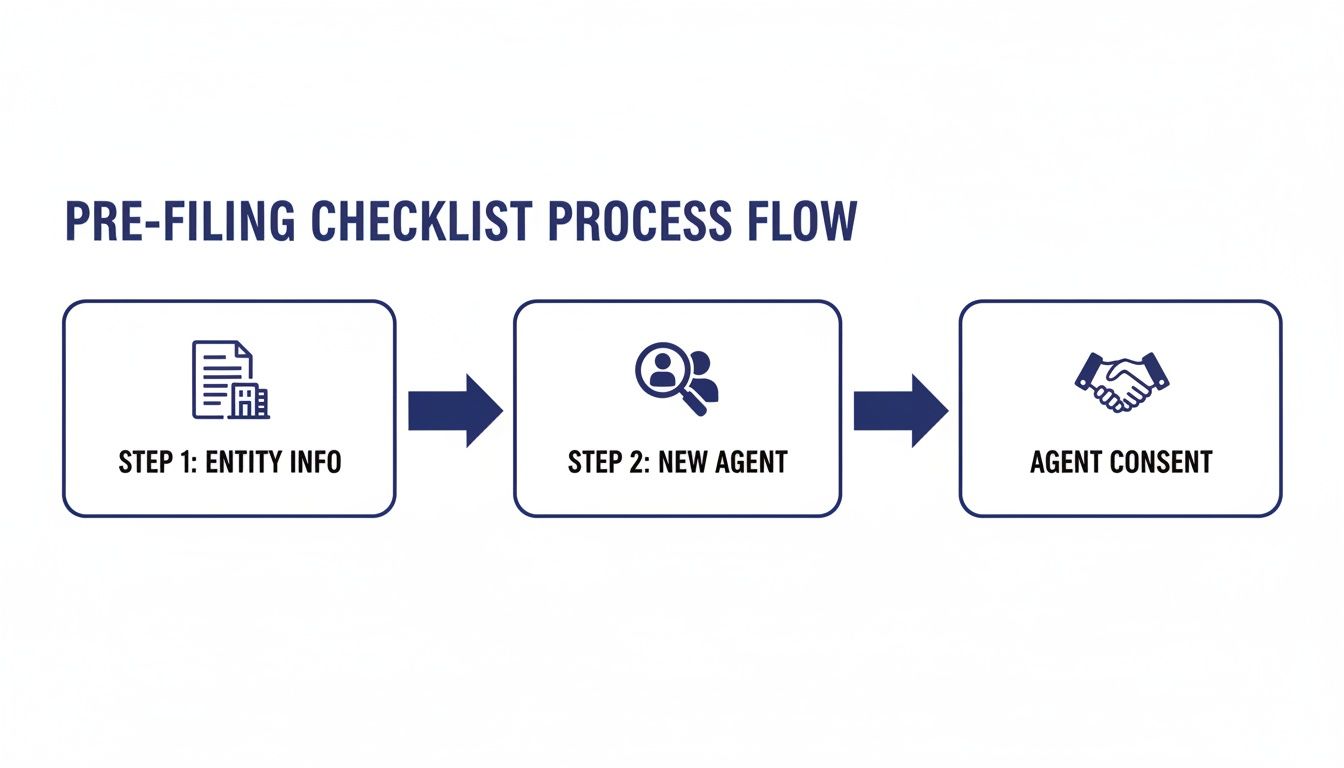

This flowchart breaks down the pre-filing checklist we've covered—getting your entity information straight, confirming the new agent's details, and, most importantly, getting their consent.

As you can see, a smooth filing is built on good preparation. Having everything in place before you start the submission process makes all the difference.

Submitting Your Form to the State

Once you’ve filled out Form 401, Texas provides a few ways to file it. Each has its own pros and cons, primarily related to speed and efficiency.

Online via SOSDirect: This is your best option. It's the fastest and most efficient method. Filings submitted through the state's online portal are typically processed within 2-3 business days. If you need confirmation quickly, this is the way to go.

Mail or Fax: If you're not in a hurry or prefer a paper trail, you can mail or fax the form. Just be prepared to wait. These traditional methods can take several weeks before the state officially processes and records the change.

No matter how you file, the standard fee is a straightforward $15. It's a small price to pay for such a vital compliance update.

Key Details to Double-Check

Accuracy is everything on this form. We've seen filings rejected for the simplest errors. A common one is using the wrong name for the new agent—you must use their exact legal name as registered with the state, not a DBA or trade name.

Another classic mistake is the address. The registered agent's address must be a physical street location in Texas. P.O. boxes are not allowed and will get your filing rejected instantly.

After you submit the form, your job isn't quite finished. It’s always a good idea to circle back and confirm the change was officially recorded. A few days after the expected processing time, search for your company on the Texas Comptroller's public database. Seeing the new agent’s name listed there is the final confirmation that you're all set and fully compliant.

For a deeper dive, check out our clear guide for U.S. business owners on changing your registered agent.

Expert Tip: The change isn't effective the moment you send the form; it's effective when the Secretary of State accepts it. This is a crucial distinction, especially if you're up against a deadline.

The Texas Business Organizations Code has specific forms for different situations. While you'll use Form 401 for this change, an agent resigning would use Form 402. If that happens, the state gives a company a tight window—just over four weeks—to appoint a new agent before falling out of compliance. For non-U.S. owners, missing this deadline is serious and can lead to an administrative termination, effectively halting all business activities.

Navigating this process carefully is key, but the real challenge often lies in avoiding simple, preventable mistakes.

Common Mistakes That Can Derail Your Filing

Changing your registered agent should be a simple update, but we've seen countless businesses stumble over small errors that create big problems. A rejected form isn't just a hassle; it can create a compliance gap, leaving your company vulnerable. We're talking about missed lawsuits, falling out of good standing, and even the state administratively dissolving your company. The stakes are surprisingly high.

Let's walk through the most common pitfalls our clients face and how you can sidestep them.

Getting the Company Details Wrong

One of the easiest ways to get your filing rejected is by fumbling your company's information on Form 401. The Texas Secretary of State's system is incredibly literal. It needs the exact legal name of your LLC or corporation, not your DBA or trade name.

Another common slip-up is entering the wrong state file number. Even a single digit off will cause the system to kick it back, forcing you to start over. Always double-check these details against your formation documents or by searching the state's database before you even begin filling out the form.

Overlooking Consent and Address Rules

This one is a big deal: you absolutely must have written consent from your new registered agent before you file the change. When you sign the form, you are legally certifying that this has happened. We’ve seen situations where a business names an agent who has no idea they've been appointed, which creates a messy and unprofessional situation down the road.

Just as important is the agent's address. Remember, a P.O. Box is never acceptable in Texas for a registered office. The law requires a physical street address where a process server can walk in and hand-deliver legal documents. Using a P.O. Box or a mail-forwarding address that isn't a true physical office is a guaranteed rejection.

Think about why this matters so much. If someone sues your company and the process server can't find your agent, you might never see the lawsuit. The court, however, could still rule that you were properly served, leading to a default judgment against you simply because you didn't show up.

It’s a nightmare scenario, but it happens. The Texas Secretary of State is clear: failing to maintain a valid registered agent can lead to involuntary termination of your company. With nearly 3 million active businesses in the state, even a small error rate means thousands of companies are putting themselves at risk. You can find more details in the official Texas registered agent FAQs.

Forgetting to Update Everyone Else

Finally, a critical mistake often occurs after the state approves your filing: forgetting to notify everyone who matters. Your business doesn't operate in a vacuum. Your bank, the IRS (for your EIN), state tax authorities, and any party to a significant contract all need your new registered agent's information.

This isn't just a courtesy; it's a crucial step to ensure official correspondence reaches you. Forgetting this can lead to missed tax notices, defaulted loans, or even breaches of contract.

At Read & Associates Inc., we see our role as more than just filing a form. We manage these details from start to finish to ensure your filing is done right the first time, protecting you from the costly headaches these common mistakes can cause.

What to Do After Your Registered Agent Is Changed

Filing your Statement of Change with the Texas Secretary of State feels like crossing the finish line, but your work isn't quite done yet. This is a common oversight we see with business owners. They handle the state filing perfectly but forget that the state is just one piece of a much larger puzzle.

To truly complete the process of changing your registered agent in Texas, you must communicate that change across your entire business ecosystem. If you don't, you create communication black holes. Sure, the state now knows where to send a lawsuit, but what about your bank, the IRS, or the vendors you have contracts with? They’re all still working off old information, which can lead to missed tax deadlines, compliance alerts, and other critical mail you can't afford to ignore.

Update Your IRS and Tax Records

First things first: let the tax authorities know. The IRS has your old registered agent's address tied to your Employer Identification Number (EIN). If they send a tax notice there, and your old agent doesn't forward it (they have no obligation to), you could be on the hook for penalties without ever knowing there was a problem.

To resolve this, you'll need to file Form 8822-B, Change of Address or Responsible Party. This is the official way to update your business mailing address with the federal government. Don't stop there; you'll also need to update your information with state-level agencies, like the Texas Comptroller of Public Accounts, to keep your state tax records in order.

Inform Your Financial and Legal Partners

Next, make a list of every financial and legal partner who has your company’s information on file. They all need the updated address for official notices, contracts, and other formal communications. It’s more than just a courtesy—it’s a compliance necessity.

Business Bank Accounts: Your bank isn’t just being nosy when they ask for current records. They're required by federal regulations to maintain accurate information. An outdated address can lead to frustrating delays or even an account freeze if they can't verify your business details.

Lenders and Investors: If you have business loans or have brought on investors, check your agreements. It’s almost certain that you're contractually obligated to keep them updated with your current contact information.

Insurance Providers: Your insurance carrier needs the correct address for legal notices. A missed communication here could jeopardize your coverage when you need it most.

For international founders, maintaining a clean and consistent compliance record is non-negotiable. During investor due diligence or for immigration purposes, any discrepancy in your official records can raise red flags and cause significant delays.

Revise Internal Company Documents

Finally, it’s time for some internal housekeeping. Your own governance documents are the official rulebook for your company, and they need to be accurate. This isn't just paperwork; it’s a critical step in maintaining your corporate formalities and protecting your personal liability shield.

Take a look at your foundational documents and make sure your new registered agent’s name and address are updated everywhere they appear. The key ones to check are:

LLC Operating Agreement

Corporate Bylaws

Partnership Agreements

Shareholder Records

Taking the time to update these documents ensures everyone—from members and partners to shareholders—is on the same page. It’s a simple act that prevents future confusion and keeps your company’s compliance posture strong. At Read & Associates, we walk our clients through this entire post-filing checklist to make sure no stone is left unturned.

Let Our Team Handle Your Texas Compliance

Changing your registered agent in Texas seems straightforward, but as we’ve seen, it's about much more than just filing a single form. It's a critical piece of your company's legal foundation. One small mistake—a typo in your entity name, a forgotten consent, or failing to notify your bank—can cause a cascade of problems. Rejected forms, missed lawsuits, and even administrative dissolution are real risks.

This is where having an expert in your corner truly pays off. Dealing with compliance details isn't just an administrative chore; it's a strategic necessity. For most business owners, especially international founders running a U.S. company from afar, time spent on paperwork is time stolen from growing the business. That's a compromise you shouldn't have to make.

Why Expert Management Is a Game-Changer

The state filing is just the beginning. Real compliance means looking at the bigger picture and connecting your registered agent change to your other legal and financial duties. This means ensuring the IRS has the right information and even updating your own internal documents like your operating agreement.

At Read & Associates Inc., we don't just see changing your registered agent in Texas as a one-off task. We treat it as an integral part of your company's overall health. Our team doesn’t just file a form; we ensure that change is properly communicated across your entire business ecosystem. It’s a proactive approach designed to give you complete peace of mind and keep your company in good standing.

Trying to manage U.S. compliance from another country adds a whole other layer of complexity. Our team is built specifically to support non-resident founders, making sure that distance and time differences never get in the way of your U.S. success.

Your Partner for the Entire U.S. Journey

Our work goes far beyond a single state filing. A registered agent is just one piece of a much larger puzzle that includes smart tax planning, solid banking relationships, and managing operations across multiple states. We handle all these interconnected pieces for you, so you can run your business with confidence.

Here’s what our team can do for you:

Complete Filing Management: We prepare and submit every necessary state form correctly and on time, every time.

Crucial Post-Filing Updates: We’ll walk you through updating your EIN, bank accounts, and other business-critical records.

Ongoing Compliance Support: We provide continuous oversight for your annual reports, tax obligations, and other state requirements.

Stop wasting your valuable time trying to decode state bureaucracy. Let our team of dedicated professionals manage the complexities of U.S. compliance so you can get back to what you do best—building your company.

If you’re ready to make sure your business is not just compliant but set up for long-term success, get in touch with Read & Associates Inc. today for a consultation.

Common Questions About Changing Your Registered Agent

When it comes to changing your registered agent, a few key questions always come up. It's a straightforward process on paper, but the details are what matter for keeping your business compliant. Here are the things Texas business owners ask our team most often.

How Long Does This Whole Process Take?

The turnaround time really depends on how you file with the Texas Secretary of State.

If you file online using the state's SOSDirect portal, you're in the fast lane. We typically see these changes processed in just 2-3 business days. It's the quickest, most efficient way to get it done.

Filing by mail or fax, on the other hand, is a different story. You'll need to be patient, as it can take several weeks for the state to process your paperwork. If you have any kind of deadline looming, we strongly advise against going the snail mail route.

Can I Just Be My Own Registered Agent?

Absolutely, you can serve as your own agent in Texas. However, you must meet a few non-negotiable requirements. First, you need a physical street address in the state—no P.O. boxes allowed. Second, you must be physically present at that address during all regular business hours to accept service of process.

For many entrepreneurs, especially those who don't live in Texas or travel often, this just isn't practical. That's why so many opt for a professional service. It guarantees someone is always available and also keeps your home address from becoming part of the public record.

What’s the Filing Fee in Texas?

The filing fee for the Form 401 (Statement of Change of Registered Agent/Office) is a modest $15. This is paid directly to the Texas Secretary of State. It's always smart to double-check the fee on the official state website right before you file, just in case they've updated it.

What Happens if I Don’t Bother Updating My Agent?

This is one of those administrative tasks you cannot afford to ignore. Failing to update your registered agent information can snowball into serious problems for your business.

Imagine missing a lawsuit summons because it was sent to your old agent. That could easily lead to a default judgment against your company simply because you never showed up to defend yourself.

Even worse, if the state finds out you don't have a valid, active registered agent, they can involuntarily terminate your business entity. This means your LLC or corporation is dissolved, your liability protection vanishes, and you lose your authority to operate in Texas. It's a huge, avoidable risk.

Keeping up with Texas compliance can feel like a full-time job, especially if you're running your business from out of state or country. The team at Read & Associates Inc. handles these critical filings so you can stay focused on what really matters—growing your company. If you want to make sure this is done right, schedule a consultation with us today.

Comments