What Is an EIN Number and How Do You Get One

- Read & Associates

- Jan 5

- 14 min read

Think of an Employer Identification Number (EIN) as your business's very own Social Security Number. It's a unique nine-digit code the IRS assigns to identify your company, and it's absolutely fundamental to operating legally and financially in the United States, especially for business owners establishing a new U.S. entity.

What Is an EIN and Why Is It Essential for Your Business?

Trying to start a business in the U.S. without an EIN is like trying to drive a car without an engine—it just won't work. This nine-digit number, first introduced by the IRS back in 1974, is the official government stamp that confirms your company is a legitimate entity.

For any business owner, and especially for international founders, obtaining an EIN isn't optional. It's the key that unlocks everything from hiring your first employee to paying taxes and opening a business bank account.

This isn't just about checking a box on a form. Your EIN is the central pillar for all your company’s financial and legal activities. Whether you're a local startup or an international entrepreneur, getting this number is one of the very first steps to building a compliant and successful business. We are experts at helping business owners navigate this process.

Key Functions of an Employer Identification Number

The following table gives a quick snapshot of just how critical an EIN is to your day-to-day operations. It's the difference between having a business idea and running an actual business.

Function | Why It Matters | Common Scenarios |

|---|---|---|

Federal Tax Filings | The IRS uses your EIN to track all your tax obligations, from income and payroll to excise taxes. | Filing your annual corporate tax return; submitting quarterly payroll tax forms. |

Opening a Business Bank Account | Banks require an EIN to open an account in your company's name, which is crucial for separating your business and personal finances. | Setting up a checking account to manage revenue and expenses. |

Hiring and Payroll | You legally cannot hire employees without one. It’s essential for reporting wages and withholding taxes. | Onboarding your first employee; running payroll through a service like Gusto or ADP. |

Building Business Credit | An EIN allows your company to establish its own credit history, separate from your personal credit score. | Applying for a business loan, line of credit, or a corporate credit card. |

Working with Vendors | Many suppliers and contractors will ask for your EIN on Form W-9 to legitimize your business relationship for their own tax reporting. | Setting up a new account with a wholesale supplier or hiring a freelance consultant. |

As you can see, the EIN touches nearly every aspect of your financial operations. It’s the identifier that proves to the government, banks, and other businesses that you're a serious, legitimate entity ready to operate.

Core Functions of Your Business EIN

An EIN makes a wide range of critical business functions possible. Without it, your company is stuck in neutral. You absolutely need one to:

File Federal Tax Returns: This is the big one. The IRS uses your EIN to identify your business for all things tax-related—income, payroll, you name it.

Open a U.S. Business Bank Account: Walk into almost any bank in the U.S., and they'll ask for an EIN to open a business account. Keeping your business and personal money separate is a must for liability protection and clean bookkeeping. For more on the founder's journey, check out our insights on the life of an entrepreneur.

Hire Employees: If you're planning to build a team in the U.S., an EIN is non-negotiable. It’s required for reporting wages and managing all necessary payroll taxes.

Build Business Credit: Your EIN allows your company to establish a credit profile completely independent of your personal finances, which opens up a world of possibilities for future loans and funding.

An EIN should be a gateway to economic opportunity, not a barrier. When business owners can quickly and easily obtain one, they can focus on what matters most: building their businesses, supporting their families, and strengthening their communities.

Ultimately, this number is your company's official ticket into the formal U.S. economy. It tells everyone—banks, vendors, and government agencies—that your business is real, recognized, and ready to play by the rules. Getting one sorted out early is a smart, strategic move for building a lasting U.S. presence.

Does Your Business Structure Require an EIN?

Figuring out if you need an Employer Identification Number (EIN) can be confusing for business owners. On one hand, the IRS has a clear set of rules. On the other, the practical realities of running a business often make an EIN a necessity, even when it’s not strictly required by law.

The official triggers are straightforward. If you hire employees, you absolutely need one. The same goes if you’ve set up your business as a corporation or a partnership, or if you file certain tax returns like employment, excise, or alcohol and tobacco. For almost any multi-member LLC or corporation, an EIN is non-negotiable.

But that’s just the government’s side of the story. For most entrepreneurs we work with, especially those outside the U.S., the real push for an EIN comes from the day-to-day demands of doing business.

Why Most Businesses End Up Needing an EIN Anyway

Even if you don't meet any of those IRS triggers, you’ll likely find it impossible to operate in the U.S. market without an EIN. This is a huge point of confusion for single-member LLCs, which the IRS often treats as "disregarded entities" for tax purposes.

Here’s the disconnect: the IRS might see your solo LLC as an extension of you, but banks and other companies don’t. They see a distinct business entity, and they need a separate business tax ID to work with you.

For international founders, the question isn't really, "Do I legally need an EIN?" It’s, "Can I actually run my business without one?" And the answer is almost always no. From banks to payment processors, an EIN is the standard proof of your business's identity.

So while you might not legally be required to get one, it's the key that unlocks the door to actually doing business in the United States.

Scenarios for International Founders

If you're an entrepreneur living outside the U.S. but have a U.S.-based LLC, the need for an EIN becomes crystal clear, fast. Even as a single-member LLC with no U.S. employees, you'll hit a wall without it.

Consider these real-world situations business owners face:

Opening a U.S. Bank Account: Try opening a business bank account in the U.S. without an EIN. It’s nearly impossible. Banks require it to verify your company is legitimate and to meet their own federal compliance rules.

Getting Paid by U.S. Clients: Many American companies will ask you to fill out a Form W-9 before they’ll pay your invoice. That form asks for a U.S. Taxpayer Identification Number—and for a business, that means an EIN.

Using Payment Processors: Services like Stripe or PayPal need to verify your business, and an EIN is often the primary document they ask for, particularly from non-resident owners.

This can all feel overwhelming, but it doesn't have to be a solo mission. Getting an EIN is a critical first step, and our team at Read & Associates Inc. is here to make sure your U.S. venture starts on the right foot. Contact us today for a consultation and let's get this foundational requirement handled for you.

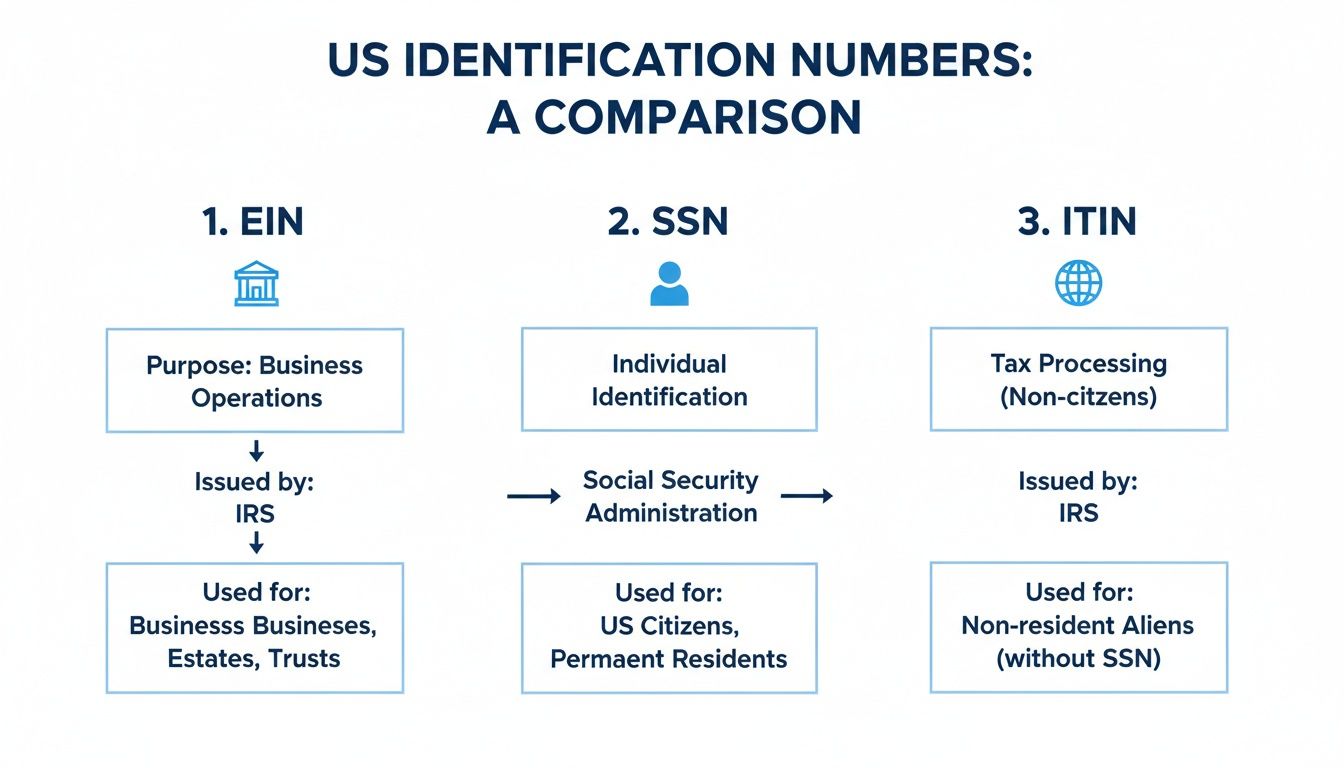

EIN vs. SSN vs. ITIN: Clarifying the Key Differences

Navigating the world of U.S. tax IDs can feel a bit like alphabet soup for business owners. You’ll constantly hear about EINs, SSNs, and ITINs, and while they all look like strings of numbers, they serve completely different purposes. Getting them straight is one of the most important first steps for any founder, especially if you're based outside the United States.

Think of it like this: your business is its own "person" in the eyes of the law and the IRS. That business needs its own official ID—that's the EIN (Employer Identification Number). You, as an individual, also have an ID. If you're a U.S. citizen or permanent resident, that's your Social Security Number (SSN). If you're a non-U.S. person who needs to file U.S. taxes but doesn't qualify for an SSN, you'll use an Individual Taxpayer Identification Number (ITIN).

The key takeaway? These numbers are not interchangeable. You can't use your personal ITIN to open a bank account for your U.S. LLC, just as you can't use your business's EIN to file your personal taxes. They have separate jobs.

Distinguishing Business and Personal IDs

At its core, the difference comes down to who or what is being identified. The Social Security Administration issues SSNs to track individual earnings and benefits. The IRS, on the other hand, issues EINs to keep track of business entities for tax purposes.

Getting a U.S. EIN isn't just a bureaucratic hoop to jump through; it's the key that unlocks your ability to do business properly. It's the federal tax ID you'll need for banking, compliance, and hiring. In fact, according to IRS regulations, over 90% of businesses need one. Since the EIN system was introduced back in 1974, it has become the standard identifier for everything from massive corporations to small non-profits. You can learn more about the specific triggers that require an EIN on the official IRS website.

This distinction is precisely why a bank will stop you in your tracks if you try to open a business account with a personal ITIN. They need the company's identifier, not the owner's.

Comparing Business and Personal Tax IDs

Let's lay it all out side-by-side to make it perfectly clear. The table below breaks down the unique role each number plays, helping you see exactly which one you need for any given situation.

Identifier | Primary Purpose | Issued To | Common Use Case |

|---|---|---|---|

EIN | Identifies a business entity for tax and financial activities. | Corporations, Partnerships, LLCs, and other business structures. | Opening a business bank account, hiring employees, and filing corporate tax returns. |

SSN | Identifies an individual for employment, taxation, and social security benefits. | U.S. Citizens, Permanent Residents, and certain temporary residents. | Personal employment, filing personal income tax returns, and opening personal bank accounts. |

ITIN | Identifies a foreign individual with a U.S. tax filing obligation. | Non-resident individuals who are not eligible for an SSN. | Filing a U.S. personal tax return (e.g., Form 1040-NR) or claiming tax treaty benefits. |

Ultimately, recognizing that your business is a separate entity with its own identity is fundamental. The IRS sees it that way, and so do banks and other institutions. Getting the right ID for the right purpose from day one is a simple step that prevents massive headaches with banking, payroll, and overall compliance down the road.

How to Apply for Your EIN: A Step-by-Step Guide

So, you’ve determined your business needs an Employer Identification Number. Great. Now comes the part that trips up a lot of founders: the application itself. The IRS gives you three ways to get it done—online, by fax, or by mail—but which route you can take really hinges on whether you have a U.S. Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

No matter which path you choose, it all comes back to one key document: Form SS-4, Application for Employer Identification Number. Think of this form as your business's official introduction to the IRS. It asks for all the critical details, like your legal name, where you're located, your business structure, and who the "responsible party" is. Getting this form right the first time is crucial. A simple typo or an incorrect box checked can send your application to the back of the line.

The Three Application Methods

Your first real decision is picking how to submit that form. The online portal is by far the fastest, but it's not open to everyone, which is a major headache for international entrepreneurs.

Online Application: This is the express lane. If you have an SSN or ITIN, you can fill out the application on the IRS website and get your EIN instantly. Just be prepared—the online session times out after 15 minutes of inactivity, so have all your information gathered before you start.

Application by Fax: For anyone without an SSN or ITIN, faxing is often the next best thing. You'll complete Form SS-4 and send it over to the correct IRS fax number. You're not getting it back in minutes, but it's usually processed within a few business days, though it can sometimes stretch into weeks.

Application by Mail: This is the classic "snail mail" route, and it's definitely the slowest. You'll pop your completed Form SS-4 in the mail and send it to the designated IRS processing center. With transit time and manual processing, you should expect to wait four weeks or more to get your EIN.

This chart helps put the EIN in context, showing how it fits alongside other U.S. tax IDs.

As you can see, the EIN is strictly for business entities, separating it clearly from the SSN for U.S. citizens and residents and the ITIN for non-resident individuals.

Special Steps for Non-Resident Founders

If you're an international founder without a U.S. tax ID, the process has a few extra hurdles. The instant online application is off-limits, which means you're stuck with either fax or mail. This is a common bottleneck and a huge source of frustration for entrepreneurs trying to get their U.S. ventures off the ground.

Because applicants outside the United States can't use the online system, they're pushed into a manual process that can take four weeks or longer. This creates a significant roadblock for international business formation.

And this isn't a niche problem. The number of new businesses needing an EIN has exploded. The U.S. Census Bureau tracks Form SS-4 filings, and their data shows a massive entrepreneurial wave. In 2021, monthly applications shot past 550,000—a 50% jump from pre-2020 levels—and we're now seeing over 5 million applications filed annually. You can dig into these trends yourself using the Federal Reserve Economic Data research.

Trying to decipher Form SS-4 requirements and navigate IRS timelines from another country is tough. One small mistake can reset the clock on an already long wait. This is exactly why getting expert help is so valuable. At Read & Associates Inc., we handle the entire EIN application process for our international clients, making sure every detail is correct to avoid unnecessary delays. Schedule a consultation with our team, and let's get this critical step handled the right way from day one.

Common Mistakes to Avoid During Your EIN Application

Getting your Employer Identification Number should be a simple box to check, but a small mistake on the application can easily turn into weeks, or even months, of frustrating delays. Knowing what trips people up is the best way to get it right the first time and keep your business moving forward.

In the rush to get started, it's easy to speed through Form SS-4 and miss something. One of the most common issues we see is simply providing incomplete or inconsistent information. Forgetting a required field or, more often, listing a business name that doesn't exactly match your official incorporation documents will get you an instant rejection, forcing you to start all over again.

Another classic mistake is applying for a second EIN when one already exists. If your business has ever had a tax ID number, even if it's been inactive for years, you have to use that one. Trying to get a new one just muddies the waters with the IRS and creates a real compliance headache later on.

Misunderstanding Critical Roles and Rules

One of the most important fields on the application is the "responsible party." This has to be an actual person—an individual, not another company—who has ultimate control over the entity's money and assets. Getting this wrong is a major red flag for the IRS and a surefire way to get your application flagged for review.

International founders have their own unique hurdles to clear. Since the online portal is off-limits if you don’t have a Social Security Number or ITIN, you must apply by fax or mail. We've seen applications get held up for something as simple as using a foreign address incorrectly or not formatting the form in a way that’s easy for manual review.

A small error in the application process doesn't just waste time; it can actively prevent you from opening a bank account, hiring staff, and generating revenue. Getting it right from the start is an investment in your business's momentum.

To help you steer clear of these roadblocks, here are a few things to lock down before you submit:

Double-Check Your Business Name: Make sure the name on your Form SS-4 is identical to what's on your official state registration documents, down to the last comma and "Inc." or "LLC."

Correctly Identify the Responsible Party: This must be a human being, like an LLC member or a corporate officer. It can never be another business entity.

For Non-Residents, Follow the Right Path: Don't even try using the online application if you lack an SSN or ITIN. The only way is to prepare a clean Form SS-4 and submit it by fax for the fastest manual processing time.

Trying to manage all these details, especially when you're operating from outside the U.S., can be a real headache. The team here at Read & Associates Inc. specializes in guiding global entrepreneurs through this exact process. Schedule a consultation with us today, and we'll make sure your EIN application is perfect from the start, saving you from those costly and completely avoidable delays.

Putting Your New EIN to Work for Your Business

Getting that official Employer Identification Number is a fantastic milestone, but it's really just the starting line. Think of your EIN as the key to a brand-new car—it’s a powerful tool, but you still have to put it in the ignition and drive.

Now that you have your EIN, you can finally make your U.S. business fully operational. This number unlocks all the essential financial tools you need to legally hire, pay, and grow in the United States. It's the piece of the puzzle that turns your registered entity into a living, breathing company.

Immediate Next Steps for Your U.S. Business

First things first: you need to build out your company's financial infrastructure. This is where your EIN immediately proves its worth by opening doors that were firmly shut before.

Here’s what you should tackle right away:

Open a U.S. Business Bank Account: This is non-negotiable and easily the most important next step. A dedicated business bank account keeps your personal and business finances separate, which is critical for protecting your personal liability and looking professional. No U.S. bank will even consider opening an account for an LLC or corporation without an EIN.

Establish Vendor and Supplier Relationships: As you start setting up accounts with suppliers or service providers, they will almost certainly ask you to fill out a Form W-9. That form requires your EIN, legitimizing your business in their system and ensuring you can pay and get paid smoothly.

Register for State-Level Taxes: Depending on what you sell and where you operate, you’ll likely need to register with state tax agencies for things like sales tax or payroll tax. Your federal EIN is the prerequisite for nearly all these state-level registrations.

Your EIN is the master key to the U.S. financial system. From banking and payroll to state tax compliance, it is the central piece of information that validates your business and allows it to operate.

Figuring out the right bank, navigating different state tax rules, and getting everything set up can feel overwhelming, especially if you’re a non-resident. This is where having an experienced partner in your corner can make all the difference.

At Read & Associates Inc., we go way beyond just securing your EIN. We provide comprehensive support to build your entire U.S. financial foundation, from setting up your books to handling ongoing tax compliance.

Let us worry about the administrative hurdles so you can focus on what you do best—growing your business. Contact us today to book a consultation and let's build your U.S. company the right way, right from the start.

Frequently Asked Questions About EINs

Getting into the weeds of Employer Identification Numbers often brings up a few key questions. Let's tackle some of the most common ones we hear from business owners just like you.

Is an EIN Free From the IRS?

Yes, it is. Getting an EIN directly from the IRS is 100% free. You should never have to pay the government for this number.

While you'll see many online services that offer to get the number for you for a fee, all they're really doing is filling out the same form you can. Professional firms like ours include EIN acquisition as part of a larger business formation or compliance package, but the IRS itself won't charge you a dime. This is part of the value we provide—handling complex processes so you can focus on your business.

How Long Does It Take to Get an EIN?

This really comes down to how you apply. If you're a U.S. resident with a Social Security Number, the online application is the way to go—you’ll get your EIN on the spot, instantly.

For international founders without an SSN, it's a different story. You'll have to apply by fax or mail, and that's when the waiting game begins. Timelines can stretch from a few weeks to even a few months, depending on how swamped the IRS is at that moment.

A quick pro-tip: You can start using your new EIN right away for things like opening a business bank account. However, hold off for about two weeks before you try to e-file any tax returns. It takes a little time for the number to fully register across all of the IRS's internal systems.

For business owners planning to operate in the U.S., understanding these nuances is key. You can find more foundational business resources and expert guidance at Read & Associates Inc.

Navigating the complexities of U.S. business formation and tax compliance can be challenging, but you don't have to do it alone. At Read & Associates Inc., we are the experts who specialize in helping international founders like you set up and manage their U.S. companies with confidence. Schedule your consultation today and let us handle the details so you can focus on growth.

Article created using Outrank

Comments